Riverdale Utah Sales Tax

The december 2020 total local sales tax rate was also 7 450.

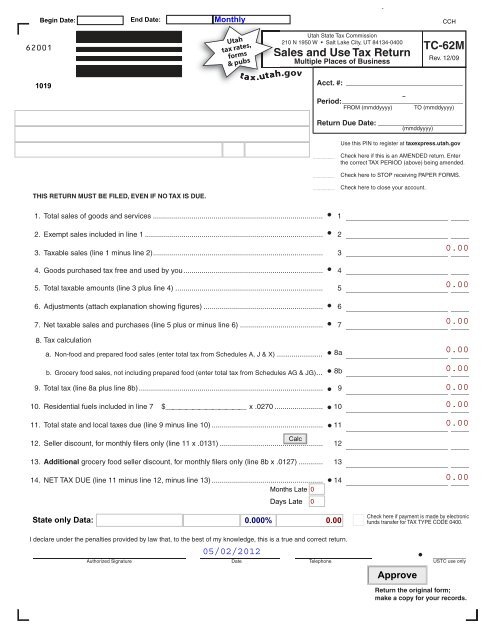

Riverdale utah sales tax. The american fork sales tax rate is 1 1. File electronically using taxpayer access point at tap utah gov. The utah sales tax rate is currently 4 85. All utah sales and use tax returns and other sales related tax returns must be filed electronically beginning with returns due nov.

The county sales tax rate is 1 65. The riverdale utah sales tax is 7 30 consisting of 4 70 utah state sales tax and 2 60 riverdale local sales taxes the local sales tax consists of a 1 65 county sales tax a 0 20 city sales tax and a 0 75 special district sales tax used to fund transportation districts local attractions etc. The combined rate used in this calculator 7 45 is the result of the utah state rate 4 85 the 84405 s county rate 1 65 the ogden tax rate 0 2 and in some case special rate 0 75. File electronically using taxpayer access point at tap utah gov.

The riverdale sales tax rate is 0 2. All utah sales and use tax returns and other sales related tax returns must be filed electronically beginning with returns due nov. For those who would rather forgo the agony of manual math calculations particularly those associated with deducting percentages. Third quarter july sept 2020 quarterly filers september 2020 monthly filers jan dec 2020 annual filers.

The current total local sales tax rate in riverdale ca is 7 975 the december 2020 total local sales tax rate was also 7 975. How to calculate sales tax in riverdale utah. The current total local sales tax rate in riverdale ut is 7 450. The county sales tax rate is 0 8.

Riverdale ca sales tax rate. The utah sales tax rate is currently 4 85. If you are a traditional pencil and notepad manual math type person you can calculate the sales tax in riverdale utah manually by using the latest sales tax rates for riverdale utah and supporting sales tax formula.